Staying the Course

By First Avenue Investment Counsel

Published June 12, 2025

As tariffs reignite fears of inflation, it is natural for investors to feel uneasy, especially with the 2022 inflation highs of 9.1% in the United States and 8.1% in Canada still fresh in the minds of many. However, inflation is cyclical, often proving more temporary than it feels in the moment. Maintaining a long-term investment perspective has historically helped investors navigate such periods.

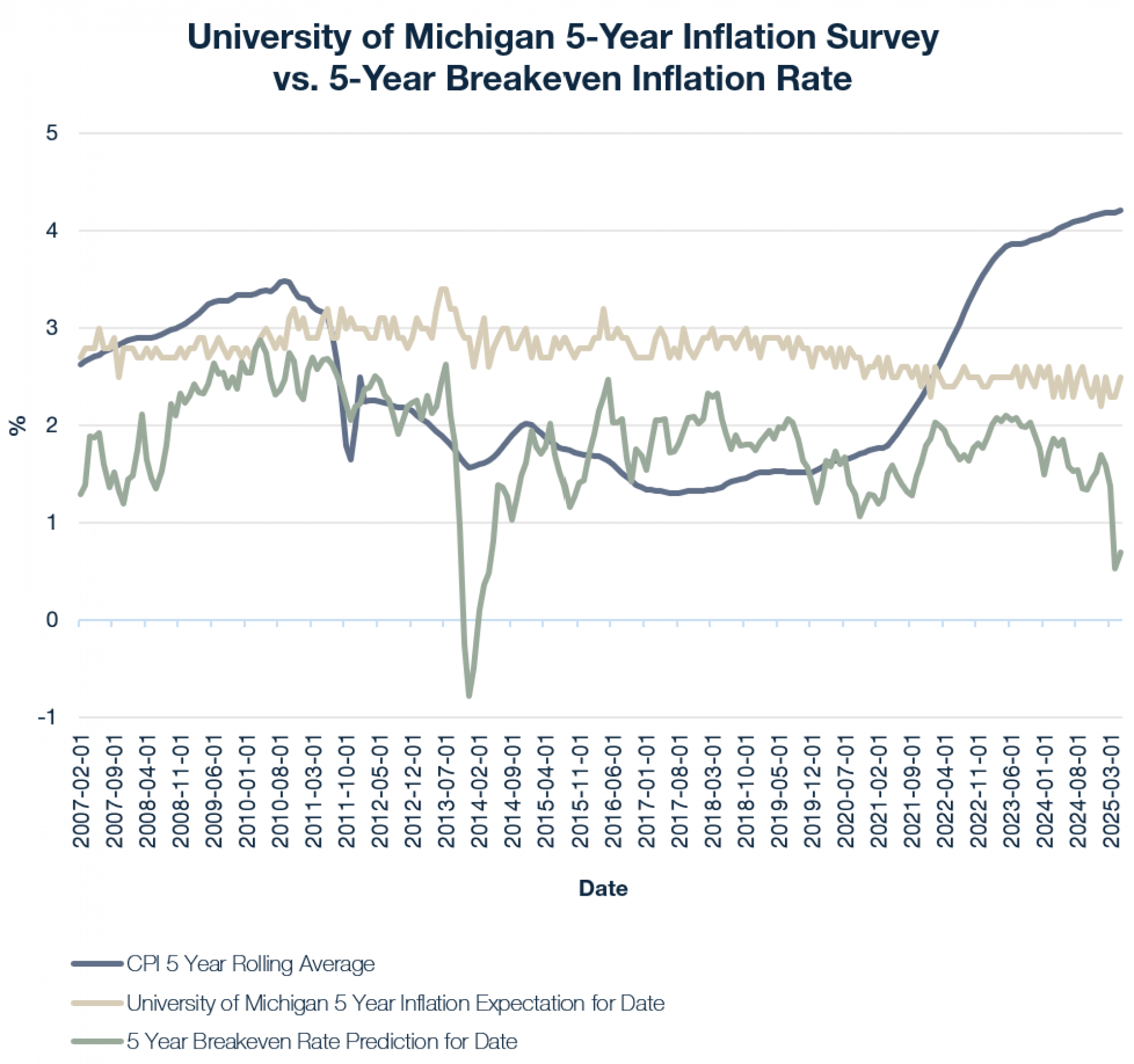

Two widely followed predictors of inflation are the 5-year Breakeven Inflation Rate and the University of Michigan 5-Year Inflation Survey. The 5-Year Breakeven Rate, derived from the bond market, is calculated by subtracting the yield on a 5-year inflation protected bond (TIPS) from the yield on a 5-year nominal treasury bond. The University of Michigan 5-Year Inflation Expectation Survey polls 500 households to gauge household expectations for inflation in the short and medium term. Amongst others, The US Federal Reserve closely monitors both indicators when making interest rate decisions. An important question to consider is: which one is more accurate?

Historically, the two measures have matched up relatively well – the average spread between them has been 87 basis points (bps) since 2002. However, recent data reveals a significant divergence: since April 2021, the average spread has increased to 107bps, a 23% increase over the historical average. In April 2025, the University of Michigan Survey forecasted inflation of 4.4% over the next five years, while the 5-Year Breakeven Rate forecasted inflation of 2.3%. This resulted in a difference of 210 bps, its greatest divergence since the 2008 Financial Crisis.[i]

Since 2002, when comparing its implicit forecast for Consumer Price Index (CPI) inflation, the 5-Year Breakeven Rate has more accurately predicted future inflation than the University of Michigan about 60% of the time. Conversely, the University of Michigan Survey, which was closer 40% of the time, proves to investors they cannot disregard the “person on the street.” Consumer spending comprises approximately 2/3 of US GDP, which underscores the importance of household expectations on economic outcomes.[ii] For investors, there is useful information to be gleaned both from the bond market and household surveys when assessing inflation.

*Source: Bloomberg, as of April 30, 2025

While these indicators provide insights into potential inflation trends, what matters most for investors is the actual manifestation of inflation and the subsequent market responses over time. Since 2002, the average five-year rolling inflation rate based on the CPI is 2.34% - just above the Federal Reserve’s target rate of 2%. In the same period, the rolling averages of the 5-Year Breakeven Rate and the University of Michigan Survey have been 1.83% and 2.77%, respectively.[iii] The Breakeven inflation rate typically forecasts lower inflation rates than those ultimately realized, whereas household expectations tend to predict higher rates than those that materialize. In a nutshell, these findings suggest that bond market investors - let’s call them the “smart money” – exhibit greater confidence in the Federal Reserve’s ability to achieve its inflation targets than is justified, while households demonstrate less trust in the Fed’s capabilities than is warranted. Said differently, the professionals may be overly confident, while the amateurs are overly fearful. Clearly though, there is useful information about future inflation to be gleaned from both groups. Crucially, in the same timeframe, the S&P 500 has earned an average annualized return of 11.4% on a five-year rolling basis even while navigating events such as the 2008 Financial Crisis and the COVID-19 Pandemic. This represents greater than 9% in annualized real return. [iv]

.png)

*Source: Bloomberg, as of April 30, 2025

Forecasting inflation, much like attempting to predict the short-term direction of the market, is inherently difficult for investors. Instead, investors should focus on what is controllable: maintaining a diversified portfolio, setting realistic investment objectives, and aligning their investment strategy with their risk tolerance and time horizon.

Inflation, volatility, and downturns are all part of the investing journey - not reasons to abandon it. While tariffs and inflation are noisy now, just as all geopolitical distractions have been from time to time over the past couple of decades, we believe that while history does not always repeat, it often rhymes. As such, we believe that maintaining a disciplined, long-term approach and staying invested will likely reward investors rather well as we go forward, just as it has in the past.

Disclosures

This article does not constitute an offer to sell, a solicitation of an offer to buy, or a recommendation of any investments, regardless of whether such security, product or service is referenced in this article. Furthermore, nothing in this presentation is intended to provide tax, legal, or investment advice and nothing in this article should be construed as a recommendation to buy, sell, or hold any investment or security, or to engage in any investment strategy or transaction. First Avenue does not represent that the securities, products, or services discussed in this article are suitable for any particular investor. You should consult your investment advisor, attorney, or tax and accounting advisor regarding your specific investment, legal or tax situation.

The forward-looking information in this presentation (information that expresses predictions, expectations, beliefs, plans, projections, objectives, assumptions, or future events or performance) is made as of the date of this article. Forward-looking information involves a number of risks and uncertainties which could cause actual results or events to differ materially from those currently anticipated. We do not undertake any obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise.

All information in this document includes information produced by our investment professionals and is current as of May 31, 2025, unless otherwise stated. Any statements or conclusions are derived from data produced from Bloomberg and/or publicly available sources unless otherwise stated. Past performance is no guarantee of future results.

[i] Source: Bloomberg

[ii] Source: U.S. Bureau of Economic Analysis, Shares of gross domestic product: Personal consumption expenditures [DPCERE1Q156NBEA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DPCERE1Q156NBEA, May 29, 2025.

[iii] Source: Bloomberg

[iv] Source: Bloomberg

Stay Informed

THANK YOU FOR CONTACTING US.

We have received your message and will be in touch.

Ottawa

World Exchange Plaza

100 Queen Street, Suite 1060

Ottawa, ON

K1P 1J9

613.909.7334

info@firstavenuecounsel.com