Tax Integration

By First Avenue Counsel

Published September 30, 2024

A fundamental principle of our Canadian tax system is integration. Tax integration is achieved when an individual experiences the same or similar after-tax result no matter the legal vehicle used to generate the income. The intention behind this principle is to eliminate any advantages or disadvantages in taxation between individuals, corporations and trusts.

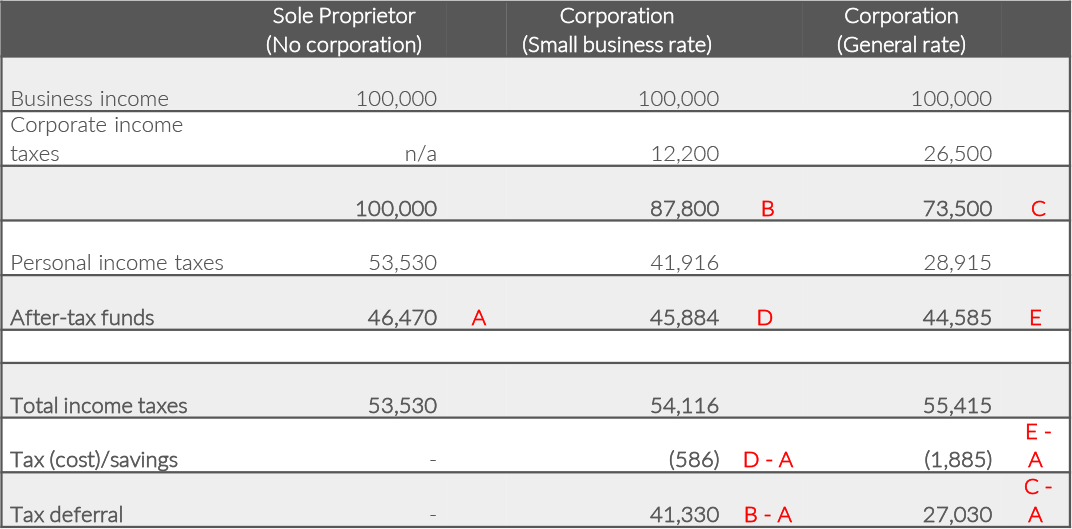

To put this principle to the test, let’s consider the following scenario dealing strictly with business income:

- Mitch, a self-employed Ontario-based photographer, earns his business income directly as a sole-proprietor and is subject to the highest marginal tax rate of 53.53%

- The small business tax rate for private corporations in Ontario is 12.20% (applicable on the first $500,000 of active business income).

- The general corporate tax rate for private corporations in Ontario is 26.50% (applicable on active business income exceeding $500,000).

- The personal tax rate on non-eligible dividends in Ontario is 47.74% (applicable on after-tax corporate funds resulting from active business income taxed at the small business tax rate of 12.20%).

- The personal tax rate on eligible dividends in Ontario is 39.34% (applicable on after-tax corporate funds resulting from active business income taxed at the general corporate tax rate of 26.50%).

We can draw the following two main observations from the analysis:

- Tax deferral: there is a significant tax deferral opportunity if Mitch has the ability to retain the after-tax business income within the corporation.

- Tax cost: Albeit minor, there is a tax cost if Mitch requires all of the after-tax corporate income

Extracting the after-tax corporate income puts the concept of integration into focus. Mitch experienced similar personal after-tax results whether he earns his business income directly as a sole proprietor or first through a corporation.

The above illustration was limited to personal and corporate income taxes applicable to Ontario residents. There are many other variables and non-tax considerations that should be taken into account when assessing whether or not to incorporate. A thorough cost/benefit analysis taking into account one’s specific circumstances should be completed by a qualified tax professional before making any decisions.

In our planning article next quarter, we will expand on this principle in the context of passive income sources from an investment portfolio.

This presentation does not constitute an offer to sell, a solicitation of an offer to buy, or a recommendation of this investment or any other investments, regardless of whether such security, product or service is referenced in this presentation. Furthermore, nothing in this presentation is intended to provide tax, legal, or investment advice and nothing in this presentation should be construed as a recommendation to buy, sell, or hold any investment or security or to engage in any investment strategy or transaction. First Avenue does not represent that the securities, products, or services discussed in this presentation are suitable for any particular investor. You should consult your investment advisor, attorney, or tax and accounting advisor regarding your specific investment, legal or tax situation.

The forward-looking information in this presentation (information that expresses predictions, expectations, beliefs, plans, projections, objectives, assumptions, or future events or performance) is made as of the date of this presentation June 30, 2024. Forward-looking information involves a number of risks and uncertainties which could cause actual results or events to differ materially from those currently anticipated. We do not undertake any obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise. All information in this document includes information produced by our investment professionals. Any statements or conclusions are derived from data produced from Bloomberg and/or publicly available sources unless otherwise stated. Past performance is no guarantee of future results.

Stay Informed

THANK YOU FOR CONTACTING US.

We have received your message and will be in touch.

Ottawa

World Exchange Plaza

100 Queen Street, Suite 1060

Ottawa, ON

K1P 1J9

613.909.7334

info@firstavenuecounsel.com