Tax Integration: Investment Income

By First Avenue Counsel

Published November 20, 2024

A core principle of our Canadian tax system is tax integration. Tax integration is achieved when an individual experiences the same or similar after-tax result, no matter the legal vehicle used to generate the income. In this article we explore the tax integration principle on passive income, such as dividends, interest, and capital gains.

Given the complexities of corporate taxation of investment income, we will limit the introduction of new corporate tax terms to two crucial accounts designed to help with tax integration:

- Refundable Dividend Tax on Hand (RDTOH) account: Investment income earned in a corporation is taxed at a higher rate than active business income. A portion of this investment income tax is added to the RDTOH account, as a form of prepayment of taxes, and is refunded to the corporation relative to the amount of taxable dividends paid to individual shareholders.

- Capital Dividend Account (CDA): The CDA is an account designed to track the amount of funds that can be paid out of a corporation as a tax-free dividend. An example of this is the non-taxable portion of capital gains (50% before June 25, 2024 or 33.33% on or after June 25, 2024). Other components affecting the calculation of the CDA account are beyond the scope of this article.

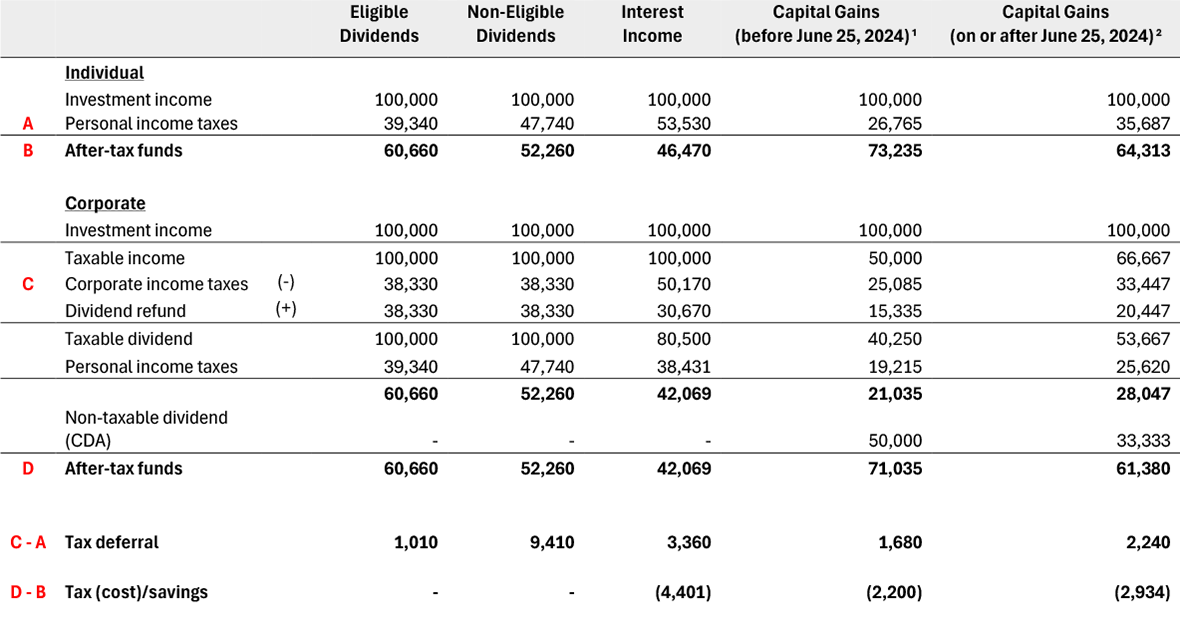

Let’s now put theory to practice with the following scenario:

- Andrea, a resident of Ontario for tax purposes, is curious about the tax result of earning passive income personally vs through a corporation. She currently manages a personal non-registered investment portfolio worth $2,000,000 and is subject to the highest marginal tax rate. The investment portfolio generates 5% per year or $100,000 before income taxes.

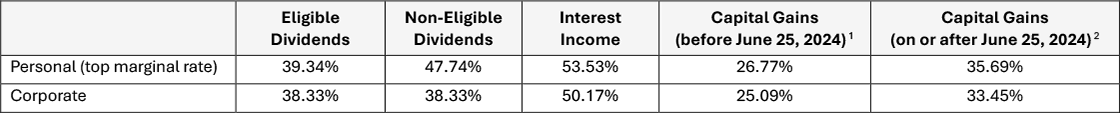

- The personal and corporate income tax rates in Ontario on passive income are as follows:

- The corporate refundable dividend tax rate in Ontario is 38.33% on dividend income and 30.67% on all other investment income. We alluded to this form of ‘prepayment of taxes’ above under the definition of the RDTOH account.

We can conclude with the following important takeaways from this analysis:

- Dividend income: There is no tax cost or savings to flowing dividend income through a corporation and ultimately to Andrea. This illustrates the concept of tax integration perfectly.

- Tax deferral: Overall, there is a slight tax deferral opportunity if Andrea has the ability to retain the after-tax investment income within the corporation (the deferral is the greatest when earning non-eligible dividends).

- Tax cost: There is a tax cost when earning interest income and capital gains within a corporation where Andrea requires all of the after-tax corporate investment income

A quick final note on capital gains. If you recall, there was an increase in the capital gains inclusion rate from 50% to 66.67% for corporations effective June 25, 2024, while the increase in the inclusion rate only applying to capital gains in excess of $250,000 per calendar year at the individual level. This should come as no surprise, the tax cost is significantly higher on the first $250,000 of capital gains when generated within a corporation relative to an individual taxpayer.

As a reminder, taxes are one of several considerations in the overall assessment of whether or not to incorporate. There are many other variables and non-tax considerations that should be taken into account. A thorough cost/benefit analysis should be completed by a qualified tax professional before making any decisions.

Disclaimer: All data and information is dated as of September 30th, 2024.

1 Effective June 25, 2024, the capital gains inclusion rate increased from 50% to 66.67% for corporations and trusts. For individuals, the increased inclusion rate applies to capital gains in excess of $250,000 per calendar year.

2 For this analysis, we have assumed that Andrea has already reached the $250,000 capital gains threshold in this calendar year.

Stay Informed

THANK YOU FOR CONTACTING US.

We have received your message and will be in touch.

Ottawa

World Exchange Plaza

100 Queen Street, Suite 1060

Ottawa, ON

K1P 1J9

613.909.7334

info@firstavenuecounsel.com